The new Maryland law gives the opportunity to change Medicare Supplement Plans without health questions. This is a game changer for Senior who are stuck paying high premiums on their Medicare Supplement plans. Previously many seniors couldn’t change plans due to from one insurance company to another that offers a lower cost due to health conditions. With the new law, Medicare Supplement individuals will be able to change companies during a very limited time of the year without answering any health questions. This is known as the Birthday Rule because from their birthday, and up to 30 after their birthday, every year Maryland Seniors can now apply without health questions for a different plan. See text of the the notice below from the Maryland Insurance Administration.

Contact us if you’d like to learn more about this new law and how it could help you save money on your Medicare Supplement plan.

You may view the original consumer notice format here: https://insurance.maryland.gov/Consumer/Documents/publications/ConsumerAdvisory-Maryland-law-allows-for-an-additional-Open-Enrollment-Period-for-Medicare-Supplement-Policies.pdf

Starting on July 1, 2023, Medicare Supplement policyholders with policies issued in

Maryland will be granted a once-yearly Open Enrollment Period that includes the

policyholder’s birthday and the 30-day period following the policyholder’s birthday. A

Medicare Supplement carrier may extend the length of this Open Enrollment Period at

their own discretion, but the period must always include the policyholder’s birthday and

the following 30-days.

Previously, Marylanders had access to an Open Enrollment Period for Medicare

Supplement plans only for a six-month period starting on their Medicare Part B Effective

Date. The Maryland General Assembly has passed a law establishing a guaranteed issue

period each year to allow a policyholder to change, without underwriting, to a Medicare

Supplement policy of equal or lesser benefits. You do not have to stay with your current

Medicare Supplement carrier. Medicare Supplement policyholders who have been underwritten and received less than

– the preferred rate are entitled to the preferred rate during the guaranteed issue period. Medicare Supplement policies are considered to have equal or lesser value unless:

– the policy contains one or more significant benefits not included in the Medicare Supplement policy being replaced; or

– the policy contains the same significant benefits included in the Medicare Supplement

policy being replaced but it reduces the cost–sharing responsibilities of the enrollee

for the benefits. Cost-sharing responsibilities do not include the policy premium.

800-492-6116 Toll-free

insurance.maryland.gov

MARYLAND LAW ALLOWS FOR AN

ADDITIONAL OPEN ENROLLMENT PERIOD

FOR MEDICARE SUPPLEMENT POLICIES

CONSUMER ADVISORY

1 Cost-sharing responsibilities do not include the policy premium.

Insurers will be required to send each Medicare Supplement policyholder an annual

notice of their right to switch policies at least 30 days, but not more than 60 days,

before the policyholder’s birthday.

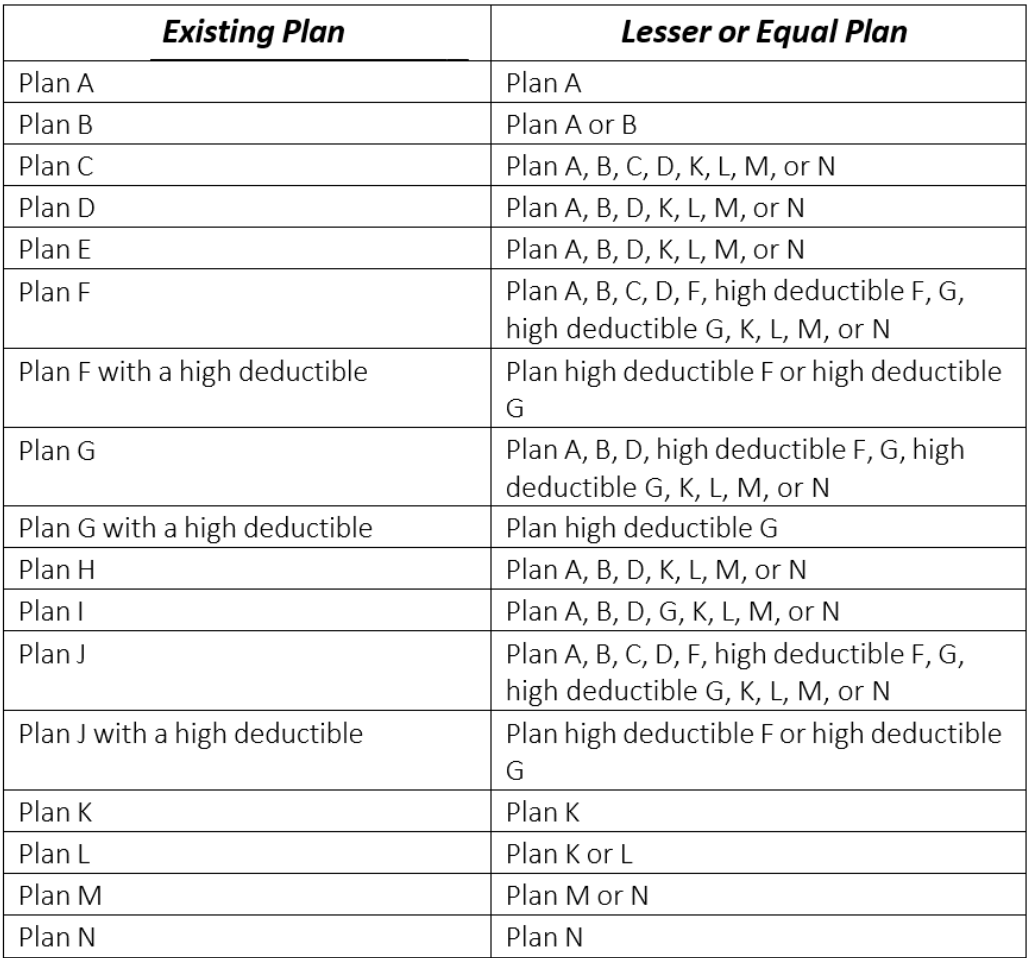

Please see the chart on the following page for details regarding Existing Plans and the

corresponding plans that have lesser or equal value:

800-492-6116 Toll-free

insurance.maryland.gov

Contact the Maryland Insurance Administration at:

200 St. Paul Place, Suite 2700

Baltimore, Maryland 21202

410-468-2000 | 800-492-6116 | 800-735-2258 TTY

https://insurance.maryland.gov/Consumer/Pages/FileAComplaint.aspx

This consumer guide should be used for educational purposes only. It is not intended to provide legal advice or opinions regarding coverage under a specific

insurance policy or contract; nor should it be construed as an endorsement of any product, service, person, or organization mentioned in this guide. Please

note that policy terms vary based on the particular insurer and you should contact your insurer or insurance producer (agent or broker) for more information.

This publication has been produced by the Maryland Insurance Administration (MIA) to provide consumers with general information about insurance-related

issues and/or state programs and services. This publication may contain copyrighted material which was used with permission of the copyright owner.

Publication herein does not authorize any use or appropriation of such copyrighted material without consent of the owner. All publications issued by the MIA

are available free of charge on the MIA's website or by request. The publication may be reproduced in its entirety without further permission of the MIA

provided the text and format are not altered or amended in any way, and no fee is assessed for the publication or duplication thereof. The MIA's name and

contact information must remain clearly visible, and no other name, including that of the insurer or insurance producer reproducing the publication, may

appear anywhere in the reproduction. Partial reproductions are not permitted without the prior written consent of the MIA. Persons with disabilities may

request this document in an alternative format. Requests should be submitted in writing to the Director of Communications at the address listed above.

ABOUT THE MARYLAND INSURANCE ADMINISTRATION

The Maryland Insurance Administration (MIA) is the state agency that

regulates the business of insurance in Maryland. If you feel that your

insurer or insurance producer acted improperly, you have the right to

file a complaint. The MIA can investigate complaints that an insurer or

insurance producer has:

Denied or delayed payment of all portions of a claim

Improperly terminated your insurance policy

Raised your insurance premiums without proper notice or in

excess of what the law allows

Made false statements to you in connection with the sale of

insurance or the processing of insurance claims

Overcharged you for services, including premium finance charges

CONTINUED

For additional details, visit the proposed regulation at

https://insurance.maryland.gov/Documents/newscenter/legislativeinformation/31.10.06-

ProposedPub-552023.pdf

For questions about this consumer advisory, please

email Patricia Dorn at patricia.dorn@maryland.gov.